How to retire with $1 million

Sep 16, 2022

If you’re wondering how to retire with $1 million, we’ve got you covered. With the right strategy, a bit of planning, and a lot of consistency, you can ace your million-dollar goal. Here’s how!

Retiring with $1 million might seem like a tall order. Perhaps your superannuation payments don’t look like they’ll add up to much - if you receive super payments at all. Maybe you’ve watched current retirees and observed a dichotomy: their net worth sits in the millions on paper, but they can’t afford a new car unless they sell their homes. And that’s BEFORE we dive into the real estate woes that our generation has faced.

In short, the prospect might seem so distant that you’ve decided to delegate the problem to Future You.

If this sounds familiar, we have good news: Present You is fully capable of reaching a $1 million retirement. What’s more, you can do it without earning a six-figure income or becoming a real estate mogul. In fact, if they allow themselves enough time, a $1 million goal is within reach for most Aussie women. This is thanks to the power of compound interest.

How compound interest can help you retire with $1 million 🤑

Albert Einstein once said: “Compound interest is the eighth wonder of the world. Those who understand it, earn it; those who don't, pay it”. In a bit, we’ll explore how compound interest can exacerbate the amount you owe on certain loans. For now, though, let’s look at how compound interest can propel you towards your first mil.

Basically, compound interest delivers “interest on interest”. In terms of financial independence, this means that the length of time you’ve been investing can be more crucial than the amount you’ve invested.

(Imaginary) example: Maria and Alejandra 👯

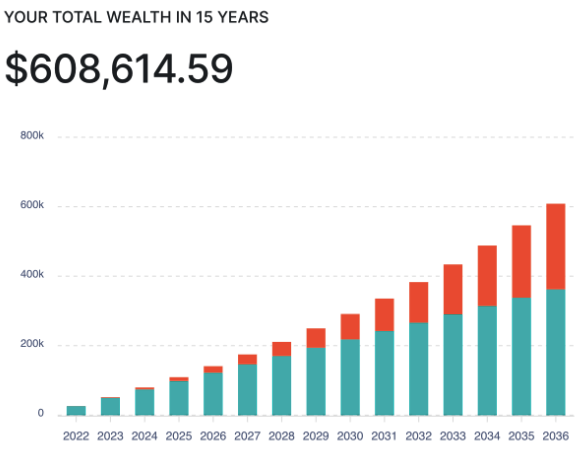

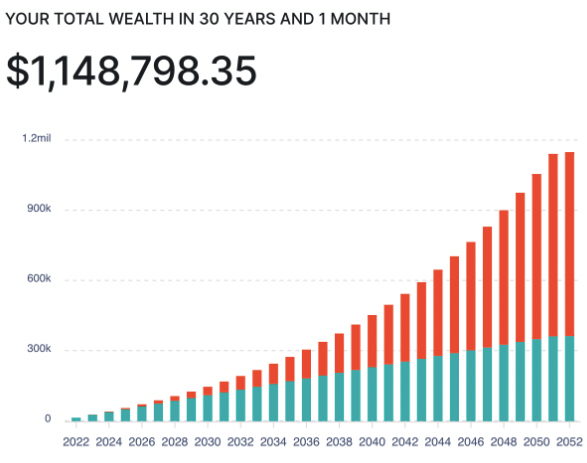

Let’s say you know two sisters - Maria and Alejandra. Maria has invested $2,000 per month for 15 years, while Alejandra has invested $1,000 per month for 30 years. In other words, both have invested $360,000. However, thanks to the power of compound interest, they both end their investing streaks on wildly different numbers…

#1: Maria

#2: Alejandra

Although both sisters invested the same amount, Alejandra finished with over $1.1 million - nearly twice as much as Maria. The only difference was that Alejandra’s money spent twice as long compounding. To learn how compounding could grow your wealth, take a look at our Compound Interest Calculator.

If you can take one fact away from this section, let it be this: when it comes to investing, today is usually better than tomorrow. The sooner you can start investing, the sooner you can benefit from the eighth wonder of the world.

BUT (and this is a big “but”) this isn’t to say you should scale back your credit repayments and throw every dollar into the stock market. Before you plant the seeds of long-term investing, there are a few financial weeds you’ll need to cull.

Kill bad debt: it’s your biggest obstacle to $1 million 💀

Remember how I said we’d circle back to the darker side of compound interest? Well, here we are. In a nutshell, if you have an interest-accruing debt, you’ll be paying compound interest on it. When the loan belongs to an asset that appreciates in value faster than the interest, it’s generally not an issue. This type of debt, which can include mortgages, is known as good debt. In contrast, whenever you borrow to buy something that doesn’t reliably appreciate in value, you’re typically assuming bad debt.

When you accrue bad debt, you end up paying more money over time for something that doesn’t grow in value. Borrowing to buy pretty much anything that isn’t property or shares falls into this category (unless you’re an expert alternative assets investor!). With this in mind, it’s important to be honest with yourself when assessing potential debt. Don’t trick yourself into thinking a new car or handbag are an “investment” and therefore warrant a loan.

Bad debts charge high interest rates too - typically ranging from 10% pa to 25% per annum (pa).

This means that, before you start investing, you should usually pay off any bad debts you have to your name. Specifically, any credit cards, personal loans and BNPL are definitely worth paying off before you invest a cent - you’ll save yourself a guaranteed 10% - 25% pa after tax.

By comparison, you can generally expect a 5% - 10% pa return from investing in shares or property (before tax). When you look at these figures, paying off bad debts before investing is a no-brainer.

If you have a car loan, it’s also worth asking yourself whether you should pay it off before investing. This will depend on your car loan rate and whether you bought it new or second-hand (hint: second-hand = far better, as the car value remains more stable).

If you do have bad debts and aren’t able to pay them off quickly, you may want to explore refinancing. For example, you may be able to take out a personal loan that charges 10% pa to pay off your credit card that’s charging you 25% pa. Alternatively, you might find a new car loan provider that will charge you 7.5% pa instead of 10% pa.

What about student debt? 🤔

In countries like Australia and the UK, most student loans are centrally managed by the government. As a result, interest rates usually sit at the rate of inflation, plus a small margin. For this reason, it can often make sense to invest in shares or property before paying off student debt. However, in countries like the US, student loans are privatised and expensive. Here, paying these debts off before investing is usually the smart move.

With your bad debts gone, you can aim for your $1M target in earnest.

Long-term investing: a steady path to retire with $1 million 💵

Alright, now that you’ve cleared your debt, you’re ready to accumulate that $1 million! But where to begin?

Shares are a strong option because they’re low-maintenance, accessible to everyone, and completely automatable. They also have excellent liquidity; this means that once you reach that magic million and look to start using some of your hard-earned invested wealth, you can do so easily - and without needing to sell large chunks at once.

Plus, the dividends you earn from shares generate returns that you can reinvest to grow your wealth. Once you reach your goal, you can pivot these returns into a passive income. It’s for these reasons that we prefer investing in shares over property to reach that million!

Now I’m not saying we should all plan to rent for life. Rather, when it comes to buying an investment property or investing in shares (which in some cases will occur after you already own your own home), we prefer shares.

Now, a concern we often hear from new investors is some version of: “I don’t know how to pick stocks.” Picking stocks is actually something we don’t back - which is why we prefer exchange-traded funds, or ETFs. ETFs are large baskets of shares from hundreds of companies. By investing in an ETF, you’re effectively diversifying your investment in one fell swoop, for a very low cost. Historically, they’ve also outperformed most professional traders who work to beat the market.

At Pearler, two of the most popular Diversified ETFs within our investing community are Vanguard Diversified High Growth Index ETF (ASX: VDHG) and BetaShares Diversified All Growth ETF (ASX: DHHF).

How to retire with $1 million on autopilot

Once you’ve decided on your ETFs, it’s time to apply Alejandra’s principles and invest on a monthly basis. The easiest way to create this habit is by setting up Automate. Automation ensures you nourish your investments regularly and helps you ignore market noise. It also empowers you to invest through the good times and the bad - a proven recipe for success called dollar-cost averaging. Just as importantly, it also saves lots of time and energy. This means you can docs more on the things you love and less on financial admin!

Shameless plug 🙈: Pearler is 100% focused on long-term investing, and also built Australia’s first automatic direct share investing feature. We’ve recently launched our third version of Automate, which enables virtually anyone to put their financial independence on autopilot.

However you invest, just remember: cushy retirements aren’t only for bankers, influencers, and realty tycoons. Clear your bad debt, create an investment plan, stick to it consistently, and you can reach your goal. Future You will thank Present You for it! 😍🤑